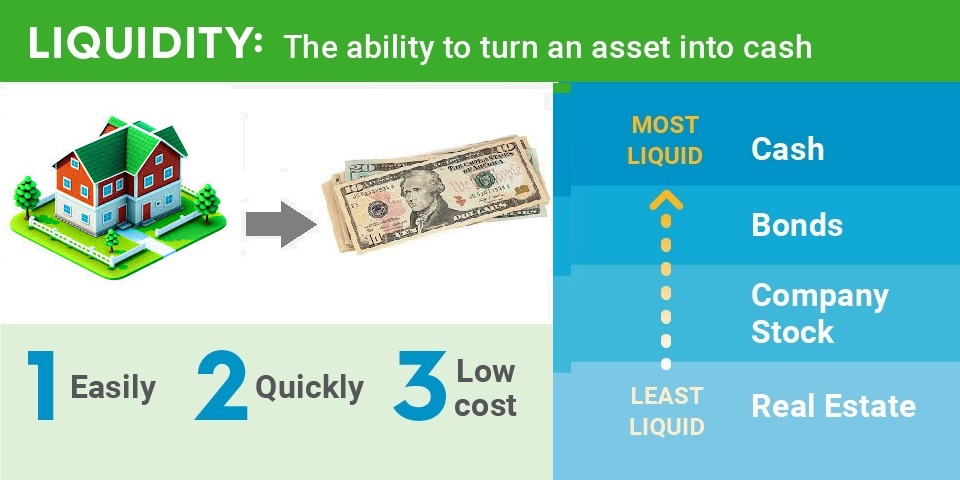

Liquidity refers to the efficiency or ease with which an asset or security can be converted into ready cash without affecting its market price. The most liquid asset of all is cash itself. Consequently, the availability of cash to make such conversions is the biggest influence on whether a market can move efficiently. The more liquid an asset is, the easier and more efficient it is to turn it back into cash. Less liquid assets take more time and may have a higher cost.

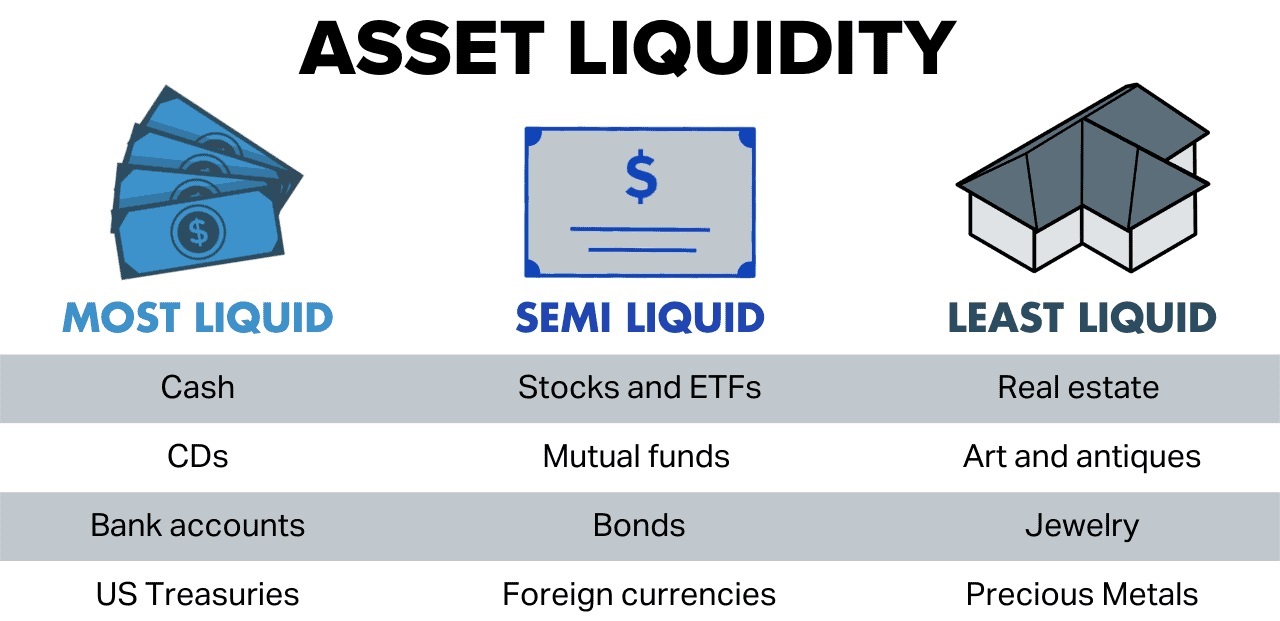

In other words, liquidity describes the degree to which an asset can be quickly bought or sold in the market at a price reflecting its intrinsic value. Cash is universally considered the most liquid asset because it can most quickly and easily be converted into other assets. Tangible assets, such as real estate, fine art, and collectibles, are all relatively illiquid. Other financial assets, ranging from equities to partnership units, fall at various places on the liquidity spectrum.1

For example, if a person wants a $1,000 refrigerator, cash is the asset that can most easily be used to obtain it. If that person has no cash but a rare book collection that has been appraised at $1,000, they are unlikely to find someone willing to trade the refrigerator for their collection. Instead, they will have to sell the collection and use the cash to purchase the refrigerator.

That may be fine if the person can wait for months or years to make the purchase, but it could present a problem if the person has only a few days. They may have to sell the books at a discount, instead of waiting for a buyer who is willing to pay the full value. Rare books are an example of an illiquid asset.

Market liquidity refers to the extent to which a market, such as a country’s stock market or a city’s real estate market, allows assets to be bought and sold at stable, transparent prices. In the example above, the market for refrigerators in exchange for rare books is so illiquid that it does not exist.2

The stock market, on the other hand, is characterized by higher market liquidity. If an exchange has a high volume of trade that is not dominated by selling, the price that a buyer offers per share (the bid price) and the price that the seller is willing to accept (the ask price) will be fairly close to each other.

Investors, then, will not have to give up unrealized gains for a quick sale. When the spread between the bid and ask prices tightens, the market is more liquid; when it grows, the market instead becomes more illiquid. Markets for real estate are usually far less liquid than stock markets. The liquidity of markets for other assets, such as derivatives, contracts, currencies, or commodities, often depends on their size and how many open exchanges exist for them to be traded on.

Accounting liquidity measures the ease with which an individual or company can meet their financial obligations with the liquid assets available to them—the ability to pay off debts as they come due.

In the example above, the rare book collector’s assets are relatively illiquid and would probably not be worth their full value of $1,000 in a pinch. In investment terms, assessing accounting liquidity means comparing liquid assets to current liabilities, or financial obligations that come due within one year.

There are several ratios that measure accounting liquidity, which differ in how strictly they define liquid assets. Analysts and investors use these to identify companies with strong liquidity. It is also considered a measure of depth.

Financial analysts look at a firm’s ability to use liquid assets to cover its short-term obligations. Generally, when using these formulas, a ratio greater than one is desirable.

1. Current Ratio

The current ratio is the simplest and least strict. It measures current assets (those that can reasonably be converted to cash in one year) against current liabilities. Its formula would be:

Current Ratio = Current Assets ÷ Current Liabilities

2. Quick Ratio

The quick ratio, or acid-test ratio, is slightly more strict. It excludes inventories and other current assets, which are not as liquid as cash and cash equivalents, accounts receivable, and short-term investments. The formula is:

Quick Ratio = (Cash and Cash Equivalents + Short-Term Investments + Accounts Receivable) ÷ Current Liabilities

3. Acid-Test Ratio (Variation)

A variation of the quick/acid-test ratio simply subtracts inventory from current assets, making it a bit more generous:

Acid-Test Ratio (Variation) = (Current Assets - Inventories - Prepaid Costs) ÷ Current Liabilities

4. Cash Ratio

The cash ratio is the most exacting of the liquidity ratios. Excluding accounts receivable, as well as inventories and other current assets, it defines liquid assets strictly as cash or cash equivalents.

More than the current ratio or acid-test ratio, the cash ratio assesses an entity’s ability to stay solvent in case of an emergency—the worst-case scenario—on the grounds that even highly profitable companies can run into trouble if they do not have the liquidity to react to unforeseen events. Its formula is:3

Cash Ratio = Cash and Cash Equivalents ÷ Current Liabilities

If markets are not liquid, it becomes difficult to sell or convert assets or securities into cash. You may, for instance, own a very rare and valuable family heirloom appraised at $150,000.

However, if there is not a market (i.e., no buyers) for your object, then it is irrelevant since nobody will pay anywhere close to its appraised value—it is very illiquid. It may even require

hiring an auction house to act as a broker and track down potentially interested parties, which will take time and incur costs.

Liquid assets, however, can be easily and quickly sold for their full value and with little cost. Companies also must hold enough liquid assets to cover their short-term obligations like bills or payroll; otherwise, they could face a liquidity crisis, which could lead to bankruptcy.

Cash is the most liquid asset, followed by cash equivalents, which are things like money market accounts, certificates of deposit (CDs), or time deposits. Marketable securities, such as stocks and bonds listed on exchanges, are often very liquid and can be sold quickly via a broker. Gold coins and certain collectibles may also be readily sold for cash.

The most liquid stocks tend to be those with a great deal of interest from various market actors and a lot of daily transaction volume. Such stocks will also attract a larger number of market makers who maintain a tighter two-sided market.

Illiquid stocks have wider bid-ask spreads and less market depth. These names tend to be lesser known, have lower trading volume, and often have lower market value and volatility. Thus, the stock for a large multinational bank will tend to be more liquid than that of a small regional bank.

The Liquidity Solutions team manages more than $400 billion in money market and short-term assets and works closely with bank, corporate and private wealth clients on a daily basis to provide liquidity management solutions to help them achieve their financial objectives.

Maintaining deep knowledge of global markets is important. But equally important is understanding your organization, investment objectives and needs. We aim to bring clarity through global research, and regional insight of local markets and regulatory issues, while providing access to specialists across our teams, portfolio managers, economists, and the broader resources of the firm.

Our approach centers around you, because we value long-term relationships. As partners, we offer you an inter- connected, collaborative global team at your disposal to deliver relevant, targeted solutions tailored to your goals. Open communication ensures everyone stays on point with your evolving needs, potential opportunities, risks and potential solutions.

Our transparency with clients is under- pinned by proactive service. We offer a comprehensive range of investment offerings—cash, fixed income and opportunistic strategies. Our independent operational support and control teams offer a disciplined approach to product governance, risk assessment and credit analysis. In addition, our robust technology ensures detailed, efficient execution and reporting.

Return to home page for more topics

Providing liquidity investment products and digital trading solutions to banks, corporates, and other institutional investors

Transforming insights into opportunities that are tailored to your investing needs across public and private markets

Premier advice, solutions, and service for select individuals and institutions

While buying a large amount of different stocks requires a sizeable budget and would be time-consuming. However, products such as ETFs make it possible to do this in a simple and cost friendly manner.

with our experts team, invest in stock markets and avoid high risk.

Insights, analytics, platforms, and client service combine to offer unmatched execution

Company-sponsored financial planning and advice for employees, from entry-level to C-suite

Embedding our developer solutions into our clients’ ecosystem so they can unlock CF Banque’ 150 years of financial expertise

Differentiated insights and timely perspectives from our expert analysts

Helping clients build a treasury of the future and powering software partners to enhance their offerings