The term Fixed Income Clearing Corporation (FICC)

refers to a regulatory clearing agency that deals with the confirmation, settlement, and delivery of fixed-income assets in the U.S. The agency was established in 2003 as a subsidiary of the Depository Trust & Clearing Corporation (DTCC). It ensures the systematic and efficient settlement and clearing of U.S. government securities and mortgage-backed security (MBS) transactions in the market.

Understanding the Fixed Income Clearing Corporation (FICC)

The Depository Trust and Clearing Corporation is a financial services company. Established in 1999, it brought together the functions of two other organizations, the Depository Trust Company and the National Securities Clearing Corporation.2 The goal of the DTCC is to provide clearing and settlement services for the financial market.3

As noted above, the FICC was established as a subsidiary of the DTCC in 2003. It was created as a result of the merger between the Government Securities Clearing Corporation (GSCC) and the Mortgage-Backed Security Clearing Corporation. The agency is registered with and regulated by the U.S. Securities and Exchange Commission (SEC).1

The role of the agency is to ensure that U.S. government-backed securities and MBS are systematically and efficiently settled. For instance, Treasury notes and bonds settle on a T+1 basis. To ensure that trades are settled consistently and efficiently, the FICC employs the services of its two clearing banks: the Bank of New York Mellon and JPMorgan Chase Bank.

Introduction to FICC and Derivatives

Fixed Income Markets

Currency Market

Commonly Markets

Special Considerations

In October 2021, the SEC announced it fined the FICC $8 million for failing to manage risk in its Government Securities Division. The SEC stated that the division lacked the appropriate risk management policies between April 2017 and November 2018. The SEC also found that the FICC didn't comply with industry rules that required it to put policies and procedures in place relating to the review of its margin coverage between 2015 and 2016.

Fixed Income Clearing Corporation (FICC) Structure

The FICC is divided into two sections: the Government Securities Division (GSD) and the Mortgage-Backed Securities Division (MBSD). We've highlighted some of the most important information about both below.

The Evolution of Electronic Trading in FICC

In today's financial markets, electronic trading has become an increasingly important component in the Fixed Income, Currencies, and Commodities (FICC) market. In the past, the traditional way of trading involved face-to-face communication and telephone calls, which resulted in a slower and less efficient market. However, the introduction of electronic trading has revolutionized the FICC market, making it faster, more efficient, and transparent. The evolution of electronic trading in FICC has not only changed the way traders operate, but it has also impacted the entire financial industry in terms of technology, regulation, and market structure.

To better understand the evolution of electronic trading in FICC, let's take a closer look at the key milestones that have shaped the market:

1. The introduction of electronic trading platforms: The first electronic trading platform for FICC was introduced in the late 1990s, which allowed traders to electronically execute trades from their desktops. This technology eliminated the need for manual processing and improved the speed and efficiency of trading.

2. The rise of algorithmic trading: As technology advanced, algorithmic trading became more prevalent. This type of trading uses mathematical models and algorithms to execute trades automatically, which can be done faster and more efficiently than manual trading.

3. The impact of regulation: In the wake of the 2008 financial crisis, regulators began to focus on improving transparency and reducing risk in financial markets. This led to the introduction of regulations such as the dodd-Frank act and MiFID II, which aimed to increase transparency and reduce risk in the FICC market.

4. The emergence of artificial intelligence (AI): In recent years, the use of AI in financial markets has increased significantly. AI can analyze large amounts of data and identify trading patterns that humans may not be able to detect, which can lead to more profitable trading strategies.

5. The role of data analytics: With the increasing use of electronic trading platforms and AI, the amount of data generated in the FICC market has grown exponentially. Data analytics can help traders make more informed decisions by providing insights into market trends and trading patterns.

The evolution of electronic trading in FICC has transformed the market, making it faster, more efficient, and transparent. The use of technology has not only changed the way traders operate but has also impacted the entire financial industry. As technology continues to advance, the future of electronic trading in FICC looks promising, and traders who harness this technology will be well-positioned for success.

Insights, analytics, platforms, and client service combine to offer unmatched execution

Operating at the center of global financial markets, our FICC and Equities professionals serve institutional clients including Asset Managers, Hedge Funds, Banks and Brokerages, Pensions, Endowments and Foundations, Corporations, and Governments. We seek to deliver to our clients leading market insight, risk management and execution, helping them to raise money, invest, and transfer risk across financial asset classes.

Is It Time to Switch from Stocks to Bonds?

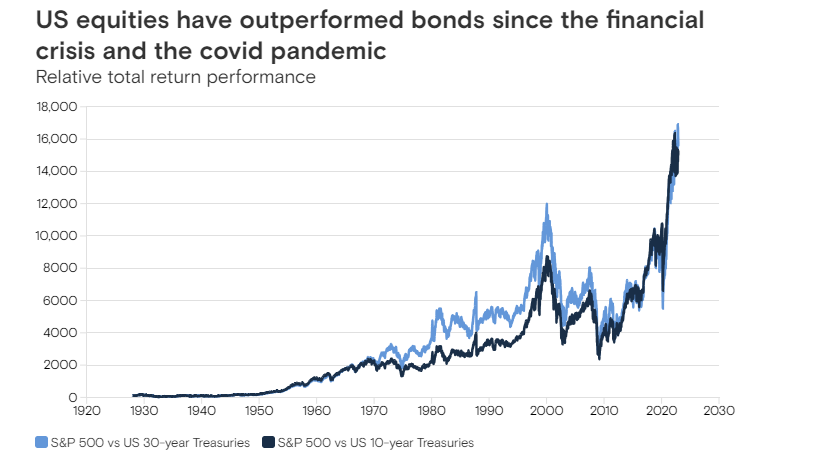

As central banks ratchet up interest rates to contain inflation, high-grade bonds are starting to give stocks a run for their money, according to CF BanqueResearch’s 2023 Outlook for Asset Allocation. As central banks ratchet up interest rates to contain inflation, high-grade bonds are starting to give stocks a run for their money, according to CF BanqueResearch’s 2023 Outlook for Asset Allocation. Bond yields trended down following the global financial crisis, making stocks seem like almost the only choice for investors seeking attractive returns. In fact, equities have materially outperformed bonds since 2008 and especially since the COVID-19 crisis — the relative performance of the S & P 500 Index versus U.S. 30-year Treasury bonds has reached new peak levels this year, much above those during the tech bubble. But after a sharp increase in bond yields this year, new and potentially less risky alternatives are emerging in fixed income: U.S. investment grade corporate bonds yield almost 6%, have little refinancing risk and are relatively insulated from an economic downturn. Investors can also lock in attractive real (inflation-adjusted) yields with 10-year and 30-year Treasury inflation protected securities (TIPS) close to 1.5%.

Source: CF Banque Research.

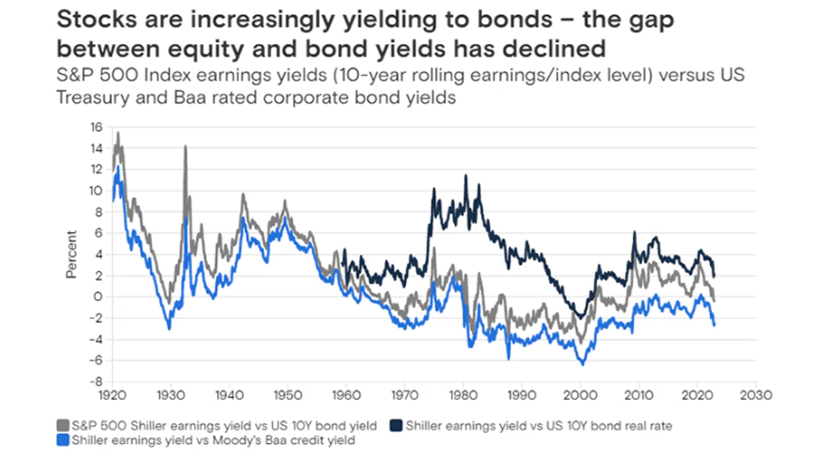

The S & P 500 Index of U.S. stocks, by contrast, has a dividend yield of only about 1.7% and a cyclically adjusted earnings yield close to 4%. The gap in yields between stock and bonds has narrowed substantially since the COVID-19 crisis and is now relatively low. The same is true for riskier credit, which yields relatively little compared with risk-free Treasuries. Investors aren’t getting much compensation for the risk of owning equities or high-yield credit in comparison to lower risk bonds. As a result, equities and high-yield debt are particularly exposed to an economic slowdown or recession. That just makes equities and riskier debt very vulnerable for disappointments on growth next year. There is less incentive to go up the risk curve because there’s not much risk premium.

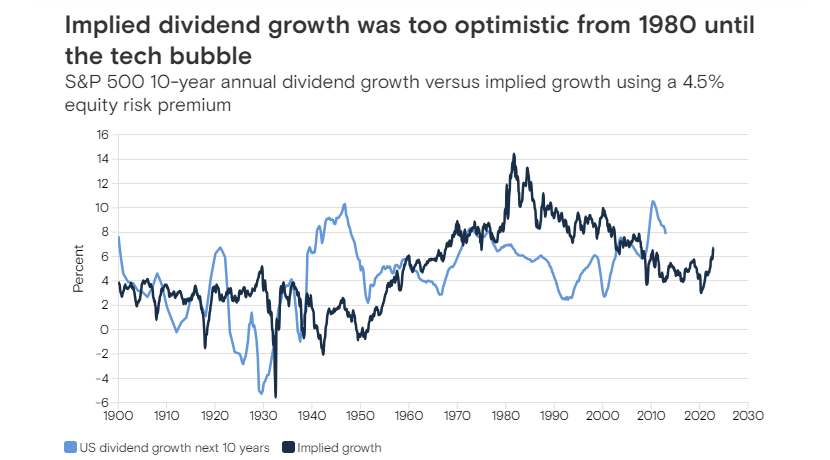

For stocks to be the better investment, investors will need to be compensated for the extra risk – this can be either through higher yields, which is currently not the case, or particularly strong growth. Indeed, the long-term growth of S & P 500 earnings necessary to achieve an equity risk premium in-line with its long-run average of 4.5% has increased to near 7%. Given the headwinds to global economic expansion, and recent inflationary trends like deglobalization, decarbonization and labour shortages (which can weigh on profit margins), it will be difficult to achieve the growth that’s embedded in stock valuations. Unless the world generates a new productivity engine, these are very optimistic kinds of numbers with everything we know right now. There’s an argument that stocks are less risky in periods of higher inflation. Equities have tended, over longer periods, to deliver a higher return than fixed-income assets in inflationary times – that might justify a lower equity risk premium, especially considering very high rates volatility this year. But economists at CF Banque expect inflation to decline in 2023, and with that rates volatility should moderate. With the risk premium having come down so much, it doesn’t compensate you for the extra risk equities may have next year with slowing global growth, U.S. growth below trend and elevated recession risk. And while bonds have been especially volatile of late, there are signs that these swings are peaking. Higher yields have also reduced the duration risk (the risk that a bond’s price will fall as rates climb) for fixed-income assets at the same time that economic growth is becoming more of a concern. That all suggests that risks are piling up for the equity market next year while bonds might become less risky.

As uncertainty about growth lingers, higher quality fixed-income assets — such as investment-grade company debt, asset-backed securities and mortgage-backed securities — may be attractive investments next year. The role of bonds in a portfolio is nevertheless changing. While government debt yields were low, or even negative, in the years after the crisis in 2008, they still offered protection to a portfolio because their prices tended to rise when equities fell. Now that interest rates have risen, they can actually offer a competitive return versus stocks, but they might not buffer so-called risk-off moves as reliably as in the last 30 years, according to CF Banque Research. And timing still matters. Ten-year U.S. Treasury yields remain low by historical standards, especially after recent declines. And because inflation is running at much higher levels than the targets set by major central banks, policymakers could surprise markets with additional hawkish shifts. Strategists at CF Banque expect yields on 2- and 10-year Treasuries to rise higher before they peak in the first half of 2023. Markets are now pricing in a more dovish Federal Reserve, signalling an expectation that the U.S. central bank will begin lowering its funds rate by the end of next year. Our economists, by contrast, don’t expect any rate cuts in 2023. If the U.S. economy turns out to be more resilient than anticipated and inflation stickier in 2023, stock markets and Treasuries could fall in price. That’s why, in the near term, bonds could remain more of a source of risk than of safety: policy rates could end up going higher, and staying there longer, than investors are prepared for, With inflation still running hot, central banks are more likely to try to cool economic growth and tighten financial conditions than to boost them. And if they don’t fight inflation, there’s a risk that longer-dated bond yields will increase anyway because of rising long-term inflation expectations. “We see potential for bonds to be less positively correlated with equities later in 2023 and provide more diversification benefits, But until central banks stop hiking and inflation normalises further, they are unlikely to be a reliable buffer for risky assets.”