In Financial Clouds, users can access the most up-to-date information, such as bank transactions, invoices, and expenses, ensuring accurate and timely financial reporting. Automation: Cloud accounting software automates various accounting processes, such as bank reconciliations, invoice generation, and expense tracking.

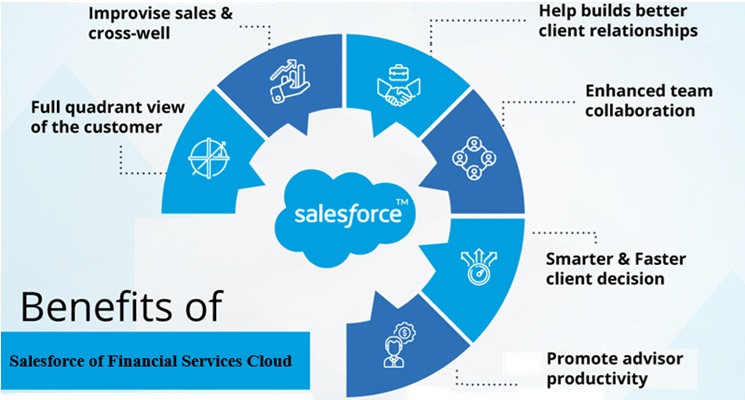

Salesforce Financial Services Cloud is a robust CRM system designed to meet the specific needs of the financial services industry. With a comprehensive data model, the platform excels in managing client information, accounts, and records, providing a 360-degree view of individual and household financial data. The integration of features like dashboards, services, and tabs enhances visibility and facilitates efficient tracking of client interactions.

One of the key advantages of Salesforce is its ability to create customized processes, empowering advisors and bankers to tailor their approach based on client needs. The platform's flexibility is evident in its adoption of Lightning components and workflows, providing a user-friendly interface for easy navigation. The ability to migrate and update data ensures that important information is always up-to-date, contributing to a streamlined workflow..

This article acts as a compilation for everything financial institutions need to know and consider when trying Salesforce FSC for themselves.

1. The foundation for the future of financial services

2. End-to-end workflows to digitize and manage assets in real-time across their lifecycle

3. Composable design to accommodate various use cases and implementations globally

4. Multi-product capabilities, such as debt and cash solutions

5. Interoperability with other platforms and networks

6. Custom participant permissioning and data privacy controls

7. Multiple connectivity methods to optimize integration uplift and infrastructure reusability

Issuers: Issue digitally native or tokenized assets - unlocking access to new liquidity and streamlining the issuance process

Investors:Access financial products seamlessly - unlocking new opportunities and portfolio strategies

Wholesale Participants:Provide services to Issuers and Investors - unlocking greater customer access and breaking down traditional industry silos.

CF Banque automates and programs assets by using smart contracts to streamline the velocity at which transactions occur.

provides real-time transparency, lifecycle management features, and risk reduction via the speed of instant settlement finality

CF Banque is a shared, immutable platform that provides the ability to certify transactions in real-time and manage assets across their lifecycle