Business Intelligence

New insights and analysis on the global economy, from across CF Banque

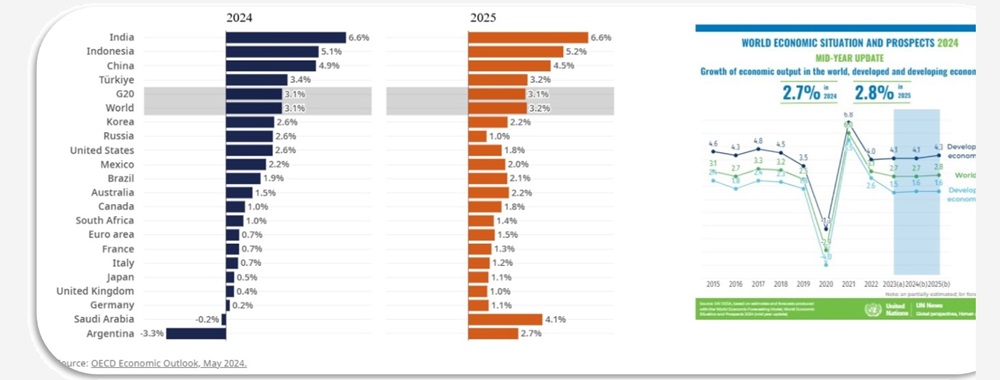

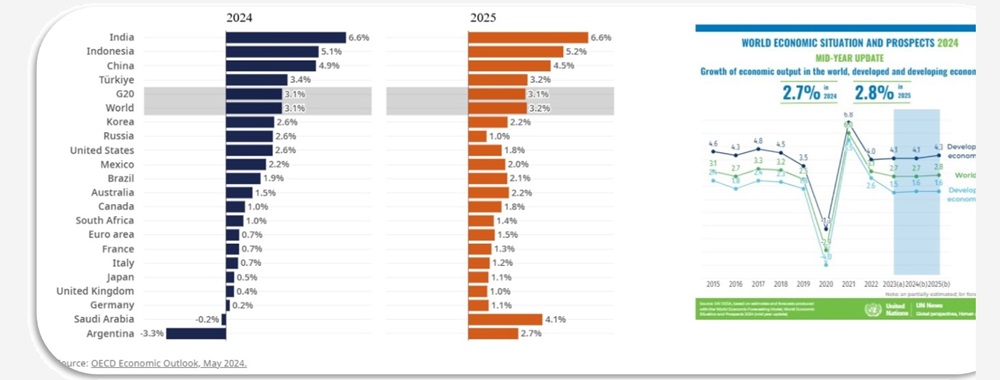

World Economy Growth

Inflation is also down from the 2023 peak, said Shantanu Mukherjee of the UN Department of Economic and Social Affairs (DESA), presenting the report to journalists in New York.

“In developed countries, tight labour markets are seeing wage increases for some parts of the population and also drawing people into the labor force, which is important,” he added.

However, the outlook is only cautiously optimistic in the face of higher-for-longer interest rates, debt sustainability risks and continuing geopolitical tensions.

Islands at risk

Ever-worsening climate shocks are also a challenge, threatening decades of development gains, especially for the world’s Least Developed Countries (LDCs) and small island developing States (SIDS).

Even though prospects for SIDS are being revised upwards to about 3.3 per cent each year, Mr. Mukherjee said this is still below the pre-pandemic average, meaning that “lost ground is still not being made up.”

In the case of Africa and LDCs in general, prospects are revised downward to about 3.3 per cent growth in 2024.

Concern for the continent

This is particularly worrying because Africa is home to about 430 million living in extreme poverty and close to 40 per cent share of the global undernourished population,” he explained. Furthermore, two-thirds of the high inflation countries listed in the report are on the continent.

“At the same time, cause for concern is that African governments’ room to maneuver is also shrinking,” he continued.

“In 2024, over a quarter of public revenues on average in this continent went towards interest payments. That's again about 10 percentage points more than the average over the years immediately preceding the pandemic.”

For developing countries, on average, the debt situation is not as dire, but he was concerned that investment growth continues to fall.

These “downsides” are further compounded by risks such as inflation, which is both a symptom of the underlying fragility and a concern on its own.

Break the ‘resource curse’

The report also contains a special section on critical minerals such as lithium, nickel, cobalt and copper, that are essential for the transition to clean energy.

Countries that possess these resources will, however, need smart policies, as well as effective implementation capacities to reap the benefits. Mineral-sector driven grown has in the past often been associated with environmental damage, stunted development of other sectors, poverty, conflict and other adverse outcomes collectively known as the “resource curse”.

“It is imperative for developing countries to design and implement well-targeted and timely economic, social, and environmental policies to optimize the benefits of their critical minerals endowments and avoid another cycle of resource curse,” the report said.

Download the report

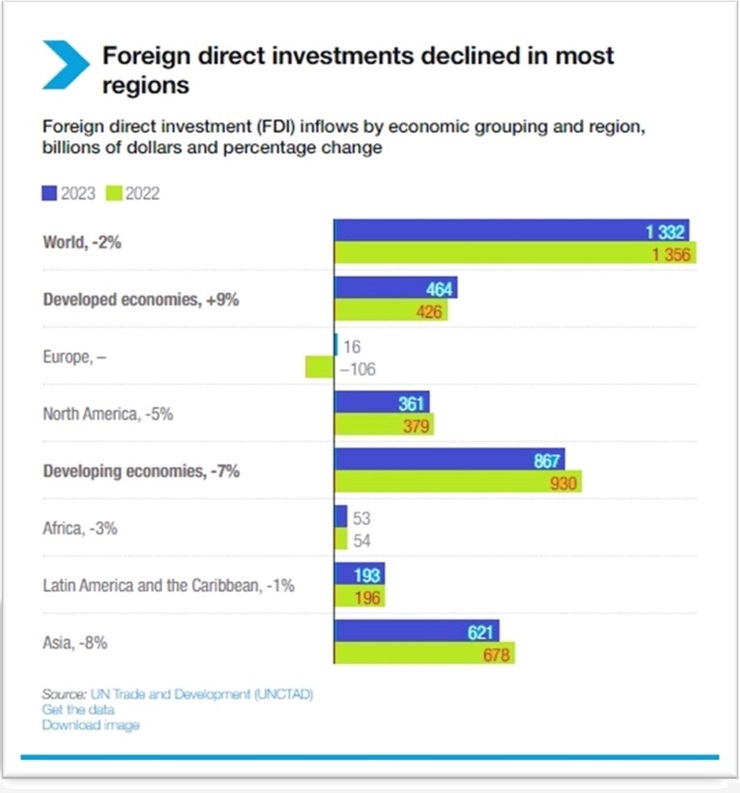

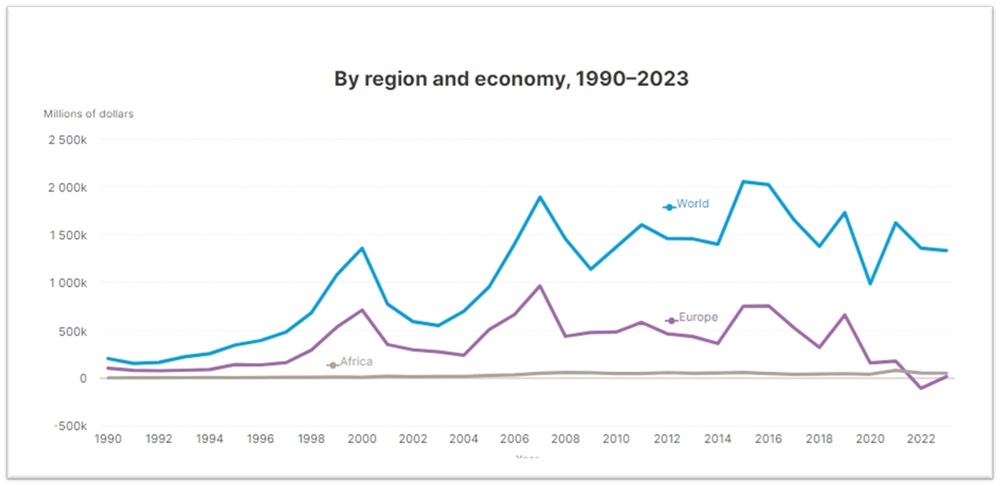

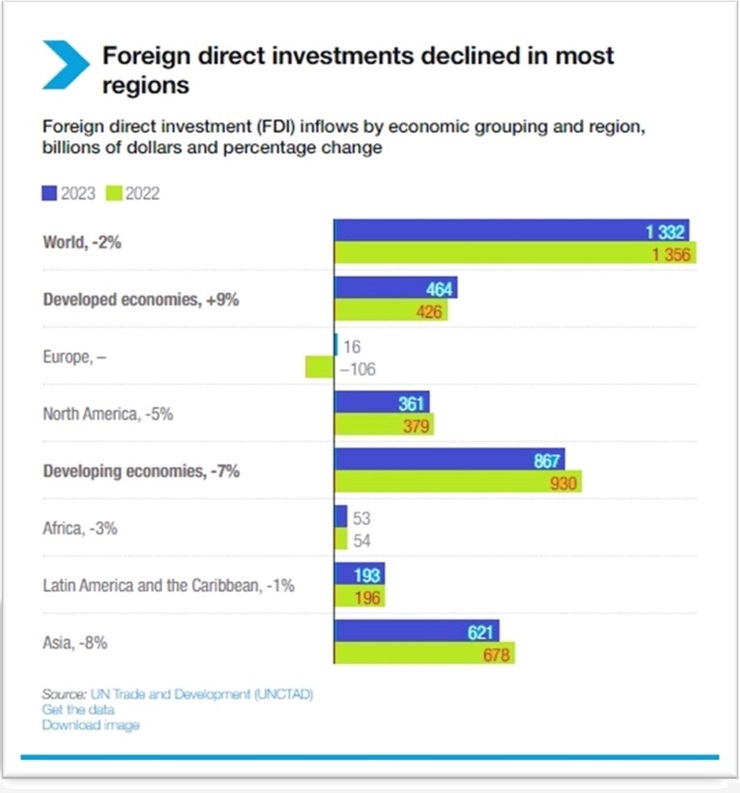

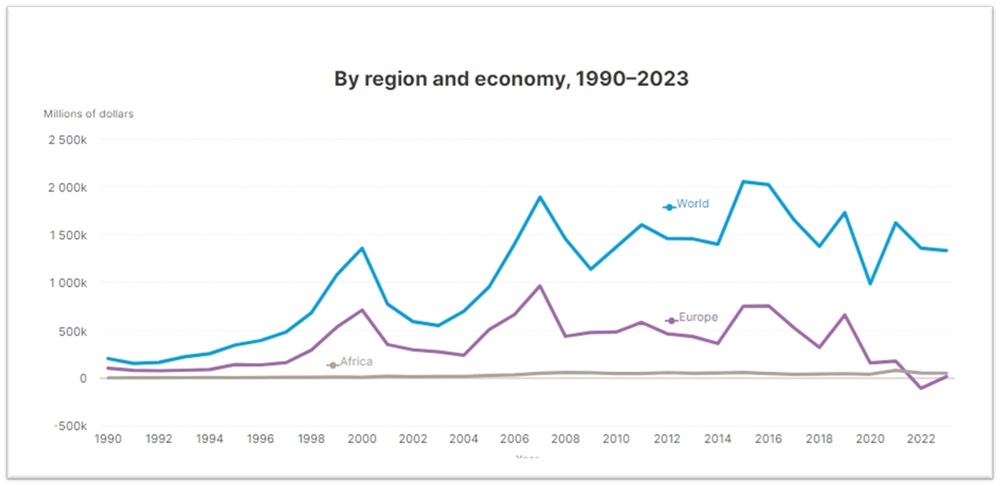

World Investment

Global foreign direct investment (FDI) fell by 2% to $1.3 trillion in 2023 amid an economic slowdown and rising geopolitical tensions, according to the World Investment Report 2024.

But the report highlights that the decline exceeds 10% when excluding the large swings in investment flows in a few European conduit economies.

The downturn in project finance affected sustainable development, with new funding for Sustainable Development Goals (SDGs) sectors dropping over 10%, particularly in agrifood and water. This hampers efforts to achieve the 2030 Agenda and calls for urgent policy action to revamp sustainable development finance.

The report emphasizes that business facilitation and digital government solutions can address low investment by creating a transparent and streamlined environment. It highlights significant growth in online services and information portals, saying such tools also support broader digital government development, benefiting developing nations in particular.Quote icon

Global foreign direct investment remains weak

Global FDI flows fell 2% to $1.3 trillion in 2023, as trade and geopolitical tensions weighed on a slowing global economy. The report underscores that the headline figure exceeds -10% when excluding a few European conduit economies that registered large swings in investment flows.

FDI flows to developing countries dropped 7% to $867 billion.

Tight financing conditions led to a 26% fall in international project finance deals, critical for infrastructure investment. International project finance is crucial for the poorest countries, making them more vulnerable to the global downturn in this type of investment.

Crises, protectionist policies and regional realignments are disrupting the world economy, fragmenting trade networks, regulatory environments and global supply chains. This undermines the stability and predictability of global investment flows, creating both obstacles and isolated opportunities.

While prospects for 2024 remain challenging, the report says modest growth for the year remains possible, citing easing financial conditions and investment facilitation efforts in both national policies and international agreements.

Investments are growing in several global value chain-intensive manufacturing sectors like automotive and electronics in regions and countries with easy access to major markets. But many developing countries remain marginalized, struggling to attract foreign investment and participate in global production networks

Download the report

The World of Finance

You may have heard the phrase, “A dollar today is worth more than a dollar in the future” but what does that really mean? This phrase derives from the time value theory of money. Money is essential for the world of finance.

Finance comprises of multiple facets including banking, credit, debt, financial markets, investing, asset management, and much more.

The world of finance revolves around managing money and how to use that money to fund projects and companies.

This world can be broken down into three main categories: personal finance, corporate finance, and public finance

Personal Finance

Personal finance involves the financial planning of managing your money and saving and investing. This includes banking, budgeting, debt, mortgages, insurance, retirement planning, and tax planning.

Personal finance is about meeting certain financial goals for individuals whether it be short-term or long-term financial goals and can be done with a financial planner or by yourself.

These goals depend on your income, expenses, living requirements, and needs that vary from person to person and by utilizing personal finance correctly, you can achieve the financial goals specific to you.

To become financially free, the first step is to start financial planning. Here are five personal finance tips to follow to reach your financial goals:

1. Use The 50/30/20 Rule

This budgeting method is widely popularized for its simplicity and offers a great framework for reaching your financial goals.

The breakdown for this method is:

• 50% of your net income goes towards needs such as rent/mortgage, utilities, transportation, and groceries. The essentials to live.

• 30% of your net income goes towards wants such as going out to eat, shopping for clothes, purchasing technology.

• 20% of your net income goes towards savings or expenses such as student debt or credit card bills.

2. Create an Emergency Fund

Most Americans don’t think about creating and emergency fund because they don’t think anything bad could happen to them in their life.

This is where they’re wrong.

For example, say the company you work for had to let you go. Instead of scrambling around looking for another job and seeming hopeless, a six month emergency fund to cover living and expenses would be able to save you in your time of need and give you time to find the right job for you.

3. Maximize Tax Breaks

The IRS is notorious for having complex rules and regulations that leave many individuals paying higher taxes without maximizing on the tax deductions available to them. Learn the tax deductions and you can maximize the deductions when doing your annual taxes.

4. Pay Off Student Loans

Depending on your interest rate, student loan debt may be present well into your mid-life years leaving you to pay interest on top of your principal years or decades after graduating from college. Paying off these loans will alleviate a large sum of your debt and give you more freedom to use your income in other ways.

5. Use Credit Cards Wisely

Credit card usage directly affects your credit score, so by utilizing credit cards wisely, you can increase your credit score rather than decrease it. A good rule to follow with credit cards is to always make on-time payments every month in full or at least above the minimum amount. This will create a good credit history and improve your credit score as you utilize credit.

Corporate finance involves financing, corporate structuring, and investment decisions related to corporations and projects within these corporations.

Corporate finance looks at the investment decisions necessary to achieve short-term and long-term financial goals within a corporation. Investment bankers and financial analysts work in this sector of finance.

In addition to these crucial decisions for a corporation, corporate finance also entails sourcing capital through initial public offerings and bonds. Forecasting the industry and determining whether to pursue a project are also financial activities in corporate finance.

Public Finance

Public or government finance is the process of spending, budgeting, and debt issuance policies that determine how the government pays for the services provided to the public. The government uses public finance to prevent market failure, stabilize cities and economies, and distribute money to citizens entitled through retirement, welfare, and social security. The government sources funding through taxation, other countries, and banks that attributes to establishing security in the United States’ financial institutions.

Download the report

New insights and analysis on the global economy, from across CF Banque

World Economy Growth

Inflation is also down from the 2023 peak, said Shantanu Mukherjee of the UN Department of Economic and Social Affairs (DESA), presenting the report to journalists in New York.

“In developed countries, tight labour markets are seeing wage increases for some parts of the population and also drawing people into the labor force, which is important,” he added.

However, the outlook is only cautiously optimistic in the face of higher-for-longer interest rates, debt sustainability risks and continuing geopolitical tensions.

Islands at risk

Ever-worsening climate shocks are also a challenge, threatening decades of development gains, especially for the world’s Least Developed Countries (LDCs) and small island developing States (SIDS).

Even though prospects for SIDS are being revised upwards to about 3.3 per cent each year, Mr. Mukherjee said this is still below the pre-pandemic average, meaning that “lost ground is still not being made up.”

In the case of Africa and LDCs in general, prospects are revised downward to about 3.3 per cent growth in 2024.

Concern for the continent

This is particularly worrying because Africa is home to about 430 million living in extreme poverty and close to 40 per cent share of the global undernourished population,” he explained. Furthermore, two-thirds of the high inflation countries listed in the report are on the continent.

“At the same time, cause for concern is that African governments’ room to maneuver is also shrinking,” he continued.

“In 2024, over a quarter of public revenues on average in this continent went towards interest payments. That's again about 10 percentage points more than the average over the years immediately preceding the pandemic.”

For developing countries, on average, the debt situation is not as dire, but he was concerned that investment growth continues to fall.

These “downsides” are further compounded by risks such as inflation, which is both a symptom of the underlying fragility and a concern on its own.

Break the ‘resource curse’

The report also contains a special section on critical minerals such as lithium, nickel, cobalt and copper, that are essential for the transition to clean energy. Countries that possess these resources will, however, need smart policies, as well as effective implementation capacities to reap the benefits. Mineral-sector driven grown has in the past often been associated with environmental damage, stunted development of other sectors, poverty, conflict and other adverse outcomes collectively known as the “resource curse”. “It is imperative for developing countries to design and implement well-targeted and timely economic, social, and environmental policies to optimize the benefits of their critical minerals endowments and avoid another cycle of resource curse,” the report said.

Download the report

World Investment

Global foreign direct investment (FDI) fell by 2% to $1.3 trillion in 2023 amid an economic slowdown and rising geopolitical tensions, according to the World Investment Report 2024. But the report highlights that the decline exceeds 10% when excluding the large swings in investment flows in a few European conduit economies. The downturn in project finance affected sustainable development, with new funding for Sustainable Development Goals (SDGs) sectors dropping over 10%, particularly in agrifood and water. This hampers efforts to achieve the 2030 Agenda and calls for urgent policy action to revamp sustainable development finance. The report emphasizes that business facilitation and digital government solutions can address low investment by creating a transparent and streamlined environment. It highlights significant growth in online services and information portals, saying such tools also support broader digital government development, benefiting developing nations in particular.Quote icon

Global foreign direct investment remains weak

Global FDI flows fell 2% to $1.3 trillion in 2023, as trade and geopolitical tensions weighed on a slowing global economy. The report underscores that the headline figure exceeds -10% when excluding a few European conduit economies that registered large swings in investment flows.

FDI flows to developing countries dropped 7% to $867 billion. Tight financing conditions led to a 26% fall in international project finance deals, critical for infrastructure investment. International project finance is crucial for the poorest countries, making them more vulnerable to the global downturn in this type of investment. Crises, protectionist policies and regional realignments are disrupting the world economy, fragmenting trade networks, regulatory environments and global supply chains. This undermines the stability and predictability of global investment flows, creating both obstacles and isolated opportunities. While prospects for 2024 remain challenging, the report says modest growth for the year remains possible, citing easing financial conditions and investment facilitation efforts in both national policies and international agreements. Investments are growing in several global value chain-intensive manufacturing sectors like automotive and electronics in regions and countries with easy access to major markets. But many developing countries remain marginalized, struggling to attract foreign investment and participate in global production networks

The World of Finance

You may have heard the phrase, “A dollar today is worth more than a dollar in the future” but what does that really mean? This phrase derives from the time value theory of money. Money is essential for the world of finance.

Finance comprises of multiple facets including banking, credit, debt, financial markets, investing, asset management, and much more.

The world of finance revolves around managing money and how to use that money to fund projects and companies.

This world can be broken down into three main categories: personal finance, corporate finance, and public finance

Personal Finance

Personal finance involves the financial planning of managing your money and saving and investing. This includes banking, budgeting, debt, mortgages, insurance, retirement planning, and tax planning.

Personal finance is about meeting certain financial goals for individuals whether it be short-term or long-term financial goals and can be done with a financial planner or by yourself.

These goals depend on your income, expenses, living requirements, and needs that vary from person to person and by utilizing personal finance correctly, you can achieve the financial goals specific to you.

To become financially free, the first step is to start financial planning. Here are five personal finance tips to follow to reach your financial goals:

1. Use The 50/30/20 Rule

This budgeting method is widely popularized for its simplicity and offers a great framework for reaching your financial goals.

The breakdown for this method is:

• 50% of your net income goes towards needs such as rent/mortgage, utilities, transportation, and groceries. The essentials to live.

• 30% of your net income goes towards wants such as going out to eat, shopping for clothes, purchasing technology.

• 20% of your net income goes towards savings or expenses such as student debt or credit card bills.

2. Create an Emergency Fund

Most Americans don’t think about creating and emergency fund because they don’t think anything bad could happen to them in their life.

This is where they’re wrong.

For example, say the company you work for had to let you go. Instead of scrambling around looking for another job and seeming hopeless, a six month emergency fund to cover living and expenses would be able to save you in your time of need and give you time to find the right job for you.

3. Maximize Tax Breaks

The IRS is notorious for having complex rules and regulations that leave many individuals paying higher taxes without maximizing on the tax deductions available to them. Learn the tax deductions and you can maximize the deductions when doing your annual taxes.

4. Pay Off Student Loans

Depending on your interest rate, student loan debt may be present well into your mid-life years leaving you to pay interest on top of your principal years or decades after graduating from college. Paying off these loans will alleviate a large sum of your debt and give you more freedom to use your income in other ways.

5. Use Credit Cards Wisely

Credit card usage directly affects your credit score, so by utilizing credit cards wisely, you can increase your credit score rather than decrease it. A good rule to follow with credit cards is to always make on-time payments every month in full or at least above the minimum amount. This will create a good credit history and improve your credit score as you utilize credit.

Corporate finance involves financing, corporate structuring, and investment decisions related to corporations and projects within these corporations.

Corporate finance looks at the investment decisions necessary to achieve short-term and long-term financial goals within a corporation. Investment bankers and financial analysts work in this sector of finance.

In addition to these crucial decisions for a corporation, corporate finance also entails sourcing capital through initial public offerings and bonds. Forecasting the industry and determining whether to pursue a project are also financial activities in corporate finance.

Public Finance

Public or government finance is the process of spending, budgeting, and debt issuance policies that determine how the government pays for the services provided to the public. The government uses public finance to prevent market failure, stabilize cities and economies, and distribute money to citizens entitled through retirement, welfare, and social security. The government sources funding through taxation, other countries, and banks that attributes to establishing security in the United States’ financial institutions.

Download the report